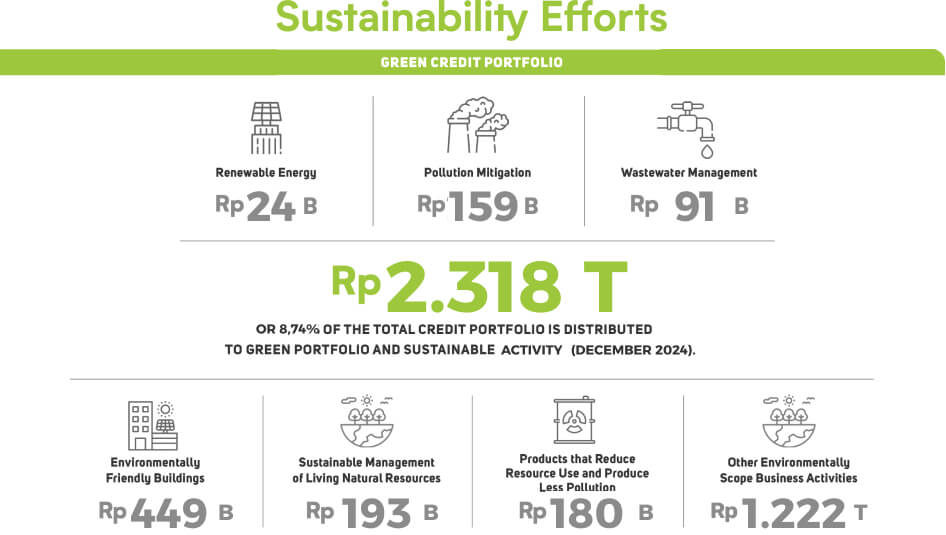

As part of the world community, PT Bank JTrust Indonesia Tbk, Tbk (J Trust Bank) actively participates in realizing the Sustainable Development Goals targets in Indonesia. Thus, in creating a sustainable business, J Trust Bank align economic, environmental, social, and governance aspects in operational and business processes.

The financial industry, including banking, through sustainable finance initiatives launched by the Financial Services Authority (OJK) encourages the implementation of responsible business, which is not only profit-oriented but is able to protect natural resources and preserve the environment for future generations.