KPR J Trust

KPR J Trust is a credit facility provided by PT Bank JTrust Indonesia Tbk. to finance purchasing of land and buildings, for newly-purchased house or second-hand house, in the form of houses, apartment, shophouses, home offices and could be used for the purpose of house construction or house renovation as well.

House, Apartment, Shophouses and Home-office

KPR Primary is a mortgage facility provided to debtor where house used as collateral is a new house purchased from the developer which collaborated with J Trust bank

KPR secondary is a mortgage facility provided to debtors for their needs :

The following are part of Secondary Mortgage product :

Financing for the transfer of mortgages from other bank to J Trust Bank using the exact same debtor and collateral

Financing for addition of existing mortgage facilities at J Trust Bank with the same exact collateral

Multipurpose mortgage is a credit facility provided by J Trust Bank, where the fund is used to finance the consumptive needs of prospective debtors, as collateral for land and buildings and/or for refinancing purposes

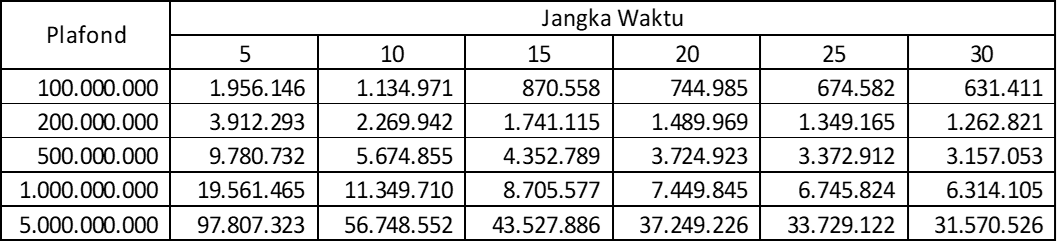

Simulation using 6.49% of promotion interest

General requirements to enroll J Trust mortgage program

No |

Document |

Employees |

Entrepeneur |

Professional |

|---|---|---|---|---|

|

1 |

Copy of ID card of the applicant and spause |

|

|

|

|

2 |

Copy of marriage certificate / divorce certificate / death certificate (For those who are married/divorced) |

|

|

|

|

3 |

Copy of Family Card |

|

|

|

|

4 |

Copy of Account Statement/Savings for the last 3 months |

|

|

|

|

5 |

Copy of personal (or spuse's) NPWP |

|

|

|

|

6 |

Original Salary Slip/Income Certificate and Position Certificate |

|

|

|

|

7 |

Copy of Profit and Loss Balance / Latest Financial Information |

- |

|

|

|

8 |

Copy of the company's deed of establishment and business permist |

- |

|

- |

|

9 |

Copy of professional practice license |

- |

- |

|

|

10 |

Copy of SHM/SHGB Collateral Ownership Documents, IMB and PBB-STTS (Proof of Payment) |

|

|

|